Showing posts with label Essential Patent. Show all posts

Showing posts with label Essential Patent. Show all posts

Thursday, May 26, 2016

Thursday, September 10, 2015

LTE Patents Licensing Royalty Issues with Connected Cars

As the connected car market glows, LTE is

becoming the main connectivity technology not only for the V2X

(vehicle-to-vehicle, vehicle-to-person, vehicle-to- roadside unit)

communications but also for providing value added services (e.g.,

infotainment). For example, the 2015

Audi A3 LTE

connectivity service includes

navigation with Google Earth and Street View, weather and event information. Thus, one may expect that the increasing use

of LTE can make the automotive sector a new patent dispute battleground. For potential patent litigation risk regarding

LTE, please see Increasing

Monetization Activities Exploiting LTE Patents.

The

main issue with the LTE patent dispute will be the reasonable royalty of LTE

standard essential patents (SEPs) that can be used for damage evaluation

regarding infringing LTE products. SEPs encompass intellectual property rights

(IPRs) for the standardized technologies.

Usually, all the essential aspects of standardized technologies are

specified in standard specifications. Thus, SEPs can be defined as patents that

include one or more claims that are infringed by the implementation of certain

standard specifications. Consequently, any

LTE standard-compatible products (e.g., LTE connectivity chipsets) may infringe

SEPs.

Standards

are often developed and set-up through the standardization process by the

standard setting organizations (SSOs). If the adopted standards are covered by some

patents owned by the members that proposed the adopted standards, the members

become the patentees of SEPs. The

patentee of SEPs may have market power in the relevant technology market

because the industry may be locked-in to using the standard and the value of

SEPs becomes significantly enhanced. Thus, the patentee can demand and obtain

unreasonably high royalty payments – hold up value - due to very high switching

cost to alternative technology the implementer should pay. Thus, the patent

hold up occurs when a patentee of SEPs demands unreasonably higher license fees

after the standard is widely adopted than could have been obtained before the

standard was implemented.

To

avoid the patent holdup problem, a majority of the SSOs require that the

members participating in the standardization process to agree ex ante to license their SEPs under

fair, reasonable, and nondiscriminatory (FRAND) terms ex post to any implementers of the standard. The members’ agreements to license their SEPs

under FRAND terms are usually called FRAND commitments. In general, FRAND commitments are interpreted

as enforceable contractual obligations between a member and an SSO. An implementer of the standard is a

third-party beneficiary of FRAND commitments and therefore entitled to a

license of SEPs.

Two

important questions about the FRAND commitments are FRAND royalty base and

rate. One may use a royalty base equal

to the entire market value of an infringing product if “the patented feature is

the basis for consumer demand” for the entire product. If the patented feature

is not the basis for consumer demand for the entire product, the royalty base

should reflect only the contribution of the patented feature to consumer

demand. Thus, if a product consists of

many components, the royalty base can be the market value of the relevant

component to consumer demand created by the patented feature.

In LaserDynamics, Inc. v. Quanta Computer, Inc., 694 F.3d 51, 68 (Fed.

Cir. 2012), the court ruled that the royalty base can be the smallest saleable

component that embodies the patented feature.

By this reasoning, the FRAND royalty base may be the smallest saleable

component that embodies the relevant SEPs.

After the FRAND royalty base was determined, a royalty rate for a

specific SEP can be calculated by taking account of the economic contribution

of the specific SEP to the smallest saleable component that is used in

determination of the FRAND royalty base.

In Microsoft v. Motorola and Google, D.C. Nos.2:10-cv-01823-JLR;

2:11-cv-00343-JLR (9th Cir. 2015), the court affirmed the lower court ruling in

determining the FRAND royalty. The district court provided basic guidelines for

assessing FRAND royalty. The district court

devised the guidelines based on the Georgia-Pacific analysis

of the reasonable royalty modified to take into account

SSOs’ primary goals for requiring FRAND

commitments. The court provided five

primary goals for adopting FRAND commitments: 1. Promotion of widespread adoption

of SSOs’ standards; 2. Avoidance of patent hold-up; 3. Avoidance of royalty

stacking; 4. Creation of valuable standards; 5. Exclusion of hold-up value in

the reasonable royalty. The court, then,

modified the Georgia-Pacific factors to account for the five

primary goals for requiring FRAND

commitments. The key modification to the Georgia-Pacific factors leads to the

reasoning that a royalty in a patent pool for the specific SEPs at issue or

comparable licensing transactions as a candidate for the royalty established

through negotiation under FRAND commitments. Thus, the royalty rate in the recently

formed LTE patent pool may provide expected FRAND licensing revenue.

Another court’s

guidelines for assessing FRAND royalty for SEPs can be found in In re INNOVATIO IP VENTURES, LLC, No.

1:11-cv-09308 (N.D. Ill. 2013), Dkt. No. 975. court calculated FRAND royalty

(cap) of WiFi SEPs using the average profit margin of the WiFi chips that cover

all the implemented features of the WiFi standard in the infringing products.

Then, the court calculated FRAND royalty by multiplying the average profit

margin to the contribution of patentee’s SEPs to the profit and pro rata share

of patentee’s SEPs to the total number of WiFi SEPs providing similar

contribution to the profit. Thus, LTE FRAND royalty can be evaluated as (average

profit margin to the contribution of patentee’s SEPs) x (net profit of relating

products) x (pro rata share of patentee’s SEPs to the total number of LTE SEPs

providing similar contribution to the profit). For example evaluation of LTE

royalty for a specific SEPs owner, please see How

much will Apple need to pay to Ericsson for a reasonable licensing royalty of

LTE patents?.

In

response to the courts’ determination of FRAND Royalty, major SEPs owners such

as Qualcomm, Nokia, Ericsson expressed their serious concerns about courts’

ruling to diminish the value of SEPs. Qualcomm insisted that there is nothing

wrong with the licensing practice of using the price of the entire end product

as the appropriate royalty base, because licensing at the end user device level

has been an industry custom in the telecommunications sector. By the telecommunications industry custom,

Qualcomm explained that patentees of SEPs usually did not enforce licensing

obligation to component manufactures. Therefore, FRAND royalty base cannot be

the smallest saleable component that embodies the relevant SEPs.

Additionally,

Qualcomm reasoned that the contribution of the patented feature to consumer

demand should not be limited to components of devices because extended

consumers’ benefits are coming from the services provided by the network

connecting devices. Therefore, the

smallest saleable component that embodies the relevant SEPs is actually the

device itself in the telecommunications sector.

Furthermore, developing standard technology in mobile telecommunications

is a high-risk business. Thus, without

strong patent protection and return for R&D, there will be no encouragement

for further investment in telecommunications standards. Consequently, artificially diminished

royalties on mobile telecommunications standard-compatible products will impede

innovation, and thus, harm to the industry and consumers ultimately.

On the

other hand, Cisco, HP, Microsoft and several other IT companies argued that the

use of the entire market value as a royalty base should not be used unless all

of the profit of the infringing product is attributed to the features of SEPs. Thus, the value of SEPs should be determined

by apportion to the contribution actually the patented features made to the

accused product. They also insisted that

patentees bear the burden of proof for the value of SEPs.

A

method to resolve disagreement about FRAND royalty base may be a hybrid

approach to royalty base that was suggested by the 3G licensing platform. The 3G licensing platform, which is the

licensing organization for 3G mobile SEPs, adopted reference market value of

the entire product as a royalty base, if the product consists of several

functional blocks. For example, if the

product performs 3G mobile communication and other functions that give values

to the users of the product, the royalty base only take into account the value

proportional to the 3G mobile communication function embedded in the entire

product. Thus, if a mobile phone of

price T includes a component of price A for mobile communication function and

other components of price B for other independent functions and multiple

components of price C for common functions supporting both mobile communication

function and other independent functions, FRAND royalty base for mobile

communication is A in the smallest saleable component approach and T in the

entire market approach. In the hybrid approach to FRAND royalty, however, FRAND

royalty base for mobile communication is A + C x [A/(A+B)] taking into account

the net contribution of the multiple components for common functions to mobile

communication. Consequently, FRAND

royalty base is a compromise value between the two extremes such that it is the

entire product value including only the smallest saleable function contributed

by the patented feature of a SEP.

©2015 TechIPm, LLC All Rights Reserved http://www.techipm.com/

Labels:

4G LTE,

Essential Patent,

IoT (Internet of Things)

Wednesday, July 8, 2015

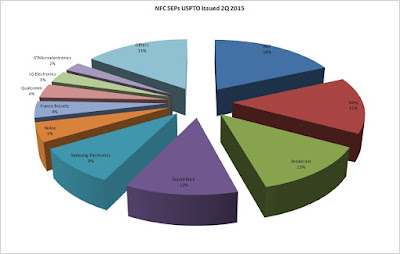

NFC Patents for Smartphone Mobile Payments 2Q 2015

NFC

(Near field communication) is a short-range wireless technology that allows

wireless connections between two devices for data exchange in various business

transactions. NFC-enabled smartphones are one of major driver for current

mobile payments market.

TechIPm

researched patents for the NFC-equipped smartphones and systems/applications

for the mobile payments, issued in the USPTO as of June 30, 2015. TechIPm’s

research identified more than 600 patents that are related to the NFC-enabled

smartphone mobile payments. The identified NFC patents are classified by

devices, systems, applications and their sub-components/systems.

Among

89 IPR holders Sony (including Sony Ericsson) is the leader followed by Visa,

NXP, Nokia, Broadcom and Samsung Electronics.

To

evaluate the essentiality of a patent for the NFC smartphone mobile payments,

patent disclosures in claims and detail description for each identified NFC

patent are compared to the industry standards for NFC technology (ISO and NFC

Forum). The NFC Forum standard specifications included in the analysis are

Activity, Digital, Protocol, LLCP (Logical Link Control Protocol), NDEF (Data

Exchange Format), RF/Analog, RTD (Record Type Definition), and Tag Operation.

Total of 164 patents are selected as the potential candidates of the NFC

standard essential patents (SEPs).

Among

24 IPR holders, NXP is the leader followed by Sony, Broadcom, Round Rock,

Samsung Electronics and Nokia.

For

more information, please contact Alex Lee at alexglee@techipm.com .

©2015

TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Labels:

Essential Patent,

Mobile Payment,

NFC,

Smartphone

Thursday, July 2, 2015

LG’s LTE Standard Patents Acquisition by NPEs: Potential Litigation Risks?

TechIPm’s

research for the patents relate to the 4G LTE standard found increasing acquisition

of LG’s LTE standard related patents by patent monetizing NPEs. LTE patents analysis for the

market leaders among LTE UE (cellular phones, smart phones, PDAs, mobile PCs,

etc.) and base station (eNB) product manufactures and innovators as of June 30,

2015 identified that many patent monetizing NPEs acquired total of 110 key

patents for the LTE standard from several major IPR holders (for the details regarding the patent analysis,

please visit http://www.techipm.com/alexdb/4G%20LTE%20Patents%20for%20Standards%20Data%201Q%202015_Intro.pdf).

Among

the total of 110 key patents for the LTE standard acquired by patent monetizing

NPEs, LG accounts for 57% (followed by Ericsson (19%) and Panasonic (11%)). As

of 2Q 2015, LG is the top IPR holders for the LTE standard related patents in

the US (accounts for 13% of 1700 patents followed by Samsung (12%) and

Qualcomm (11%)). Among the NPEs that acquired patents for the LTE standard, Optis

Cellular Technology accounts for 51% followed by Evolved Wireless (11%) and Thomson

Licensing (9%).

Considering

the recent increasing monetization activities involving patent infringement lawsuits exploiting LTE patents (for

details, please visit http://techipm-innovationfrontline.blogspot.com/2015/04/increasing-monetization-activities.html)

it is expected that the acquired LG’s LTE standard related patents can be the

potential patent litigation risks for the LTE related industry (Smartphone, Connected Car, Wearable/IoT devices etc.),

Recently,

Evolved Wireless has filed patent infringement lawsuits against

Apple, Samsung, Microsoft, HTC and Lenovo ((Evolved Wireless v. Samsung

Complaint: http://www.slideshare.net/alexglee/evolve-wiress-lg-v-samsung-lte-standard-patents) exploiting

five LG’s LTE standard related patents (7,746,916, 7,768,965, 7,809,373,

7,881,236, and 8,218,481). Another potential litigation risk will be the

acquisition of LG's patents by Optis Wireless Technology. Optis Wireless Technology sued ZTE exploiting

the LTE patents acquired from Panasonic.

For more information, please contact Alex Lee

at alexglee@techipm.com.

©2015 TechIPm, LLC

All Rights Reserved http://www.techipm.com/

Wednesday, May 27, 2015

IoT (Internet of things) Wireless Connectivity Standards Innovation Leadership

As the number of granted patent is a good

measure of innovation activities, issued US patents that are related to the key

wireless standards for the IoT connectivity (LTE, Wireless LAN, Zigbee,

Bluetooth, NFC, UHF RFID) are analyzed to evaluate the technology innovation

leadership. More than 10,000 issued patents as of May 15, 2015 are

reviewed. Patent disclosures in claims

and detail description for each patent are analyzed as to whether the contents

are within the scope of key technologies for the relevant standard

specifications (3GPP, IEEE, ISO, NFC Forum, Bluetooth SIG). For details about

the analysis, please refer “Wireless Patents for Standards &

Applications 1Q 2015”

(http://www.slideshare.net/alexglee/wireless-patents-for-standards-applications-1q-2015).

More than 3,000 patents hold by more than 160

assignees are identified as the key wireless standard patents for the IoT

connectivity. Samsung Electronics is the leader followed by LG Electronics,

Qualcomm, Nokia, Google, Ericsson, Intel, Apple, InterDigital, Sony, Broadcom,

BlackBerry, Texas Instruments, Marvell, Panasonic, ETRI, NEC and Cisco.

For more information, please contact Alex Lee

at alexglee@techipm.com.

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Monday, May 25, 2015

WPAN (Bluetooth & Zigbee) Patents for Standard Ranking

As the number of patent applications is a

good measure of innovation activities, to evaluate the WPAN (Bluetooth

including Bluetooth LE and Zigbee) technology innovation activities, more than

2000 issued patents in the USPTO obtained from the carefully constructed keyword

search are reviewed. Patent disclosures

in claims and detail description for each patent are analyzed as to whether the

contents are within the scope of key technologies (e.g. modulation &

coding, PHY & MAC frames & functions, Link Management etc.) for the

IEEE 802.15.1, IEEE 802.15.4 and Bluetooth Core 2 – 4 standard specifications.

More than 290 issued patents are identified

as the key patents for the IEEE 802.15.1, IEEE 802.15.4 and Bluetooth Core 2 – 4

standard specifications as of 1Q 2015. Among 82 IPR holders, Broadcom is the

leader followed by Samsung Electronics, Nokia, Qualcomm, Texas Instruments,

Philips, Ericsson, Intel, BlackBerry, ETRI and Sony.

For more information, please contact Alex Lee

at alexglee@techipm.com .

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Saturday, May 16, 2015

The U.S. Holds IPR Leadership in Patents for Wireless Standards

To evaluate the IPR leadership in wireless

communications, the US patents that are related to the key wireless standards

are analyzed. The wireless patens are

grouped by mobile wireless communications (4G LTE) related patents and fixed wireless

communications (WLAN, WPAN, NFC) related patents. Patent disclosures in claims and detail

description for each patent are analyzed as to whether the contents are within

the scope of key standard specifications (3GPP, IEEE, ISO, NFC Forum). Top 20 patent holders for each group are then selected

to rank the combined IPR shares. For

details about the analysis, please refer “Wireless Patents for Standards &

Applications 1Q 2015”

(http://www.slideshare.net/alexglee/wireless-patents-for-standards-applications-1q-2015).

For the mobile wireless communications IPR, LG

Electronics is the leader followed by Samsung Electronics, Qualcomm, Google, Ericsson,

Nokia, Apple, InterDigital, BlackBerry and Panasonic. For the fixed wireless

communications IPR, Sony is the leader followed by Intel, Marvell, Samsung

Electronics, Qualcomm, Broadcom, Cisco, NXP, Philips and Texas Instruments.

Combining the mobile and fixed wireless communications IPR, Samsung Electronics

is the leader followed by LG Electronics, Qualcomm, Intel, Sony, Nokia, Google,

Ericsson, Marvell and InterDigital.

The combined IPR shares for the top 20 IPR

holder’s countries based on the location of headquarter show that the U.S. holds

IPR leadership in patents for the key wireless standards.

For more information, please contact Alex Lee

at alexglee@techipm.com

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Tuesday, April 28, 2015

WiFi (IEEE 802.11 WLAN) Patents for Standard Ranking

As the number of patent applications is a

good measure of innovation activities, to evaluate the WiFi technology

innovation activities, more than 4000 issued patents in the USPTO obtained from

the carefully constructed keyword search are reviewed. Patent disclosures in claims and detail

description for each patent are analyzed as to whether the contents are within

the scope of key technologies (e.g. modulation & coding, PHY & MAC

frames & functions, Access Control etc.) for the IEEE 802.11 a/b/g/e/i/n

standard specifications.

More than 8oo issued patents are identified as

the key patents for the IEEE 802.11 a/b/g/e/i/n standard specifications as of

1Q 2015. Among 85 IPR holders, Marvell is the leader followed by Intel, Samsung,

Qualcomm, Sony, Cisco, Broadcom, Philips, Texas Instruments and Toshiba.

For more information, please contact Alex Lee

at alexglee@techipm.com .

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Thursday, April 9, 2015

LTE patent pool accounts for around 10% of LTE standard essential patents IPR share in the US

Google

announced addition of its LTE patents acquired from Motorola Mobility to Via

Licensing's LTE Patent Pool (Ref. http://www.usatoday.com/story/tech/2015/04/09/google-joins-wireless-patent-group/25478395/).

Via Licensing's LTE Patent Pool Licensors are AT&T, China Mobile, Clear

Wireless, Deutsche Telekom, DTVG Licensing, Google, Hewlett-Packard, KDDI, NTT

DOCOMO, SK Telecom, Telecom Italia, Telefonica, ZTE. Before the joining of

Google, ZTE was only the LTE smartphone manufacture among LTE Patent Pool Licensors.

In

recent TechIPm, LLC’s 4G LTE standard essential

patents research for the US market leader among 4G LTE UE (cellular phones,

smart phones, PDAs, mobile PCs, etc.) and base station (eNB) product

manufactures and innovators (Ref. http://techipm-innovationfrontline.blogspot.com/2015/01/4g-lte-patents-for-standard_8.html),

Google ranked 6th in IPR share for 4G LTE standard essential patent candidates

as of 1Q 2014. By the addition of Google as its licensors, Via Licensing's

LTE patent pool now accounts for around 10% of LTE standard essential patents

IPR share in the US.

For more information, please contact Alex Lee at

alexglee@techipm.com .

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Friday, April 3, 2015

Increasing Monetization Activities Exploiting LTE Patents

Recent

TechIPm’s research for patents relate to 4G LTE standard found increasing

monetization activities exploiting LTE standard related patents. LTE patents analysis for the market leaders

among LTE UE (cellular phones, smart phones, PDAs, mobile PCs, etc.) and base

station (eNB) product manufactures and innovators identified more than 1600

issued patents hold by 42 entities in the US as of March 31, 2015 (ref.

http://www.techipm.com/alexdb/4G%20LTE%20Patents%20for%20Standards%20Data%201Q%202015_Intro.pdf

).

Among

42 LTE patents holders, NPE accounts for 11% IPR share of LTE standard related

patents. Identified NPE IPR shareholders are Adaptix, ETRI, InterDigital, Innovative

Sonic, Inventergy, IPR Licensing, ITRI, Optis Wireless Technology, Seoul

National University, Thomson Licensing and UPIP. Recent monetization activities

exploiting LTE patents among NPE shareholders are as follows.

Adaptix,

a subsidiary of Acacia Research, sued several telecom operators including

AT&T and smartphone manufactures including HTC for infringement of its 4G

LTE patents (ref. http://www.law360.com/articles/616031/adaptix-ramps-up-at-t-htc-patent-feud-despite-setback

). Adaptix entered into patent license agreements with several entities

including NEC as settlements for patent dispute (ref. http://finance.yahoo.com/news/acacia-subsidiary-resolves-action-nec-105900394.html

).

InterDigital

sued several smartphone manufactures including Nokia for infringement of its 4G

LTE patents and entered into patent license agreement with Samsung as a

settlement for patent dispute (ref. http://www.pcworld.com/article/2359140/samsung-signs-cellular-patent-deal-with-interdigital-ending-all-litigation.html

).

UPIP

sued several smartphone manufactures including Huawei for infringement of its

4G LTE patents in Germany and the UK (Ref. http://www.businesswire.com/news/home/20140310005655/en/Unwired-Planet-Announces-Enforcement-Action-Germany-United#.VR6pAfnF-HA

).

Recently,

Optis Wireless Technology sued ZTE for infringement of its 4G LTE patents

acquired from Panasonic (Ref. http://www.rfcexpress.com/lawsuits/patent-lawsuits/texas-eastern-district-court/949460/optis-wireless-technology-llc-et-al-v-zte-corporation-et-al/summary/

).

Inventergy

is actively operating its licensing program exploiting its 4G LTE patents

acquired from Panasonic (Ref. http://www.marketwatch.com/story/inventergy-launches-standardized-licensing-initiative-for-mobile-device-manufacturers-2015-03-09

).

In

addition to NPE IPR holders, Ericsson and Nokia (both entities are accounts for

13% IPR share of LTE standard related patents) are actively involved in monetization

exploiting LTE patents:

Ericsson

sued Samsung for infringement of its 4G LTE patents and entered into patent

license agreements with Samsung as a settlement for patent dispute (Ref. http://www.reuters.com/article/2014/01/27/us-ericsson-samsung-patents-idUSBREA0Q0A120140127

). Ericsson also sued Apple for infringement of its 4G LTE patents (Ref. http://www.cellular-news.com/story/Legal/67300.php

). Licensing royalty of Ericsson that can have from Apple is expected to be

around $200 M per year (Ref. http://techipm-innovationfrontline.blogspot.com/2015/03/how-much-will-apple-need-to-pay-to.html

).

Nokia

sued HTC for infringement of its 4G LTE patents and entered into patent license

agreements with HTC as a settlement for patent dispute (Ref. http://www.theinquirer.net/inquirer/news/2327794/htc-and-nokia-end-legal-spat-with-patents-agreement

).

For

more information, please contact Alex Lee at alexglee@techipm.com .

©2015

TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Labels:

4G LTE,

Essential Patent,

Patent Monetization

Monday, March 9, 2015

UHF RFID Standard Essential Patents 1Q 2015

TechIPm,

LLC’s UHF RFID standard

essential patents research for the US market identified total of 170 issued patents in the USPTO as

the potential candidates for UHF RFID standard essential patents as of 1Q, 2015.

To evaluate

the essentiality of a UHF RFID patent, patent disclosures in claims and detail description

for each UHF RFID patent is compared to ISO/IEC 18000-C technical specifications. Among 18 IPR shareholders, Round Rock

Research LLC, a patent assertion entity, is

the leader followed by Symbol Technology, Intermec, ZIH (Zebra), Impinj, Atmel, and Alien.

Round

Rock Research LLC was founded by a billionaire John Desmarais, a famous patent

attorney for his won in a $1.52 billion verdict for Alcatel-Lucent against

Microsoft in 2007. Round Rock Research LLC became the second-largest NPE

following the Intellectual Ventures by acquiring a portfolio of 4,500 patents

from Micron Technology Inc., the biggest U.S. maker of semiconductor chips.

Recently, Round Rock settled patent disputes with several UHF

RFID manufactures. Round Rock Research LLC is

now operating successful licensing program collaborating with IPVALUE, an IP

monetization consulting firm.

For more

information, please contact Alex Lee at alexglee@techipm.com .

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Sunday, March 8, 2015

How much will Apple need to pay to Ericsson for a reasonable licensing royalty of 4G LTE patents?

Recently, Ericsson sued Apple for infringement over 41 Ericsson patents including

4G/LTE standard essential patents (SEPs) related to Apple's iPhones and iPads. Ericsson said Apple owes it patent royalties for

using its wireless technologies in the iPhone and iPad, but Apple refused its

fair and reasonable licensing offer.

Notwithstanding the recent administrative and judicial

blocking against exploiting SEPs for injunction,

several courts ruled that SEPs are still eligible for monetary relief for

infringement. In Microsoft Co.,

v. Motorola, Inc., No. 2:10-cv-01823-JLR (W.D. WA), the court provided basic

guidelines for assessing FRAND royalty for SEPs.

The guidelines are based on the Georgia-Pacific analysis of

the reasonable royalty (Georgia-Pacific Corp. v. U.S. Plywood Corp., 318 F.

Supp. 1116, 1120 (S.D.N.Y. 1970)) modified for taking into account SSOs’

primary goals for adopting FRAND commitments. The key modification to the Georgia-Pacific factors leads

to the reasoning that a royalty in a patent pool for the specific SEPs at

issue or comparable licensing transactions as a candidate for the royalty

established through negotiation under FRAND commitments. Thus, the royalty

rate in the recently formed LTE patent pool may provide expected FRAND

licensing revenue.

Another court’s guidelines for assessing FRAND royalty

for SEPs can be found in In re INNOVATIO IP VENTURES, LLC, No. 1:11-cv-09308

(N.D. Ill. 2013), Dkt. No. 975. The INNOVATIO

IP VENTURES court calculated

FRAND royalty (cap) of WiFi SEPs as (average profit margin to the contribution

of patentee’s SEPs) x (net profit of relating products) x (pro rata share of

patentee’s SEPs to the total number of WiFi SEPs providing similar contribution

to the profit). Similar calculation can also lead to the FRAND royalty (cap)

for 4G LTE smartphone SEPs.

To evaluate Apple’s 4G LTE smartphone SEPs licensing

royalty owed to Ericsson, Ericsson’s IPR share in 4G LTE SEPs is researched.

Recent TechIPm, LLC’s research for 4G LTE standard related patent in the US reviles Ericsson’s 4G LTE smartphone SEPs’ IPR share is around 7% (for details about

analysis method, please refer to 4G LTE

Patents for Standard Innovativeness Ranking: http://techipm-innovationfrontline.blogspot.com/2015/01/4g-lte-patents-for-standard_8.html).

Then, based on various market research data as of 4Q 2014,

the net profit of Apple from smartphone sales per year in the US market is calculated as roughly $10 B. Finally, if the average profit margin to the

contribution of the 4G LTE SEPs of 3% (smallest scalable product base) is assumed,

the licensing royalty of Ericsson that can have from Apple is expected to be around $200

M per year.

For more information, please contact Alex Lee at

alexglee@techipm.com .

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

©2015 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Labels:

4G Mobile Technology,

Essential Patent,

LTE,

Smartphone

Tuesday, December 30, 2014

NFC Standard Essential Patent Candidates Data 4Q 2014

NFC (Near field communication) is the key technology for Smartphone wallet application: A Smartphone including an electronic wallet provides a variety of financial and payment capabilities. The Smartphone wallet application supports paying for products or services in much the same way as presenting a credit card, a debit card, a smart card, a transit card, or a toll tag for payment. The Smartphone wallet can communicate wirelessly with a point-of-sale (POS) terminal using NFC technology to provide the appropriate financial information to complete a payment transaction. There are many Android and Windows phones offer NFC applications. Recently, France Brevets sued HTC and LG for patent infringement using two Inside Secure’s NFC patents.

To find the key IPR holders for NFC patents, a keyword search of the USPTO patent data base and ISO/IEC standard essential patents (SEPs) data base have been performed. To evaluate the essentiality of a NFC patent, patent disclosures in claims and detail description for each NFC patent are compared to industry standard for NFC technology (under development by the NFC Forum). The NFC Forum standard specifications included in the analysis are Activity, Digital, Protocol, LLCP (Logical Link Control Protocol), NDEF (Data Exchange Format), RF/Analog, RTD (Record Type Definition), Connection Handover, and Tag Operation.

NFC Standard Essential Patent Candidates Data

provides current assignee name, USPTO and EPO family issued patent number (with

Hyper-link to Google patents), related standard specifications, title, and

abstract.

©2014 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Sunday, August 3, 2014

4G LTE Standard Essential Patents Candidates Evaluation 3Q 2014

TechIPm, LLC’s 4G LTE standard essential

patents (SEPs) research for the US and EU market leader among 4G LTE UE

(cellular phones, smart phones, PDAs, mobile PCs, etc.) and base station (eNB)

product manufactures and innovators identified total of 447 issued patents in

the USPTO and EPO as the potential candidates for 4G LTE RAN (Radio Access

Network) SEPs as of July 31, 2014.

To evaluate the essentiality of a LTE patent,

patent disclosures in claims and detail description for each 4G LTE patent are

compared to the final versions of the 3GPP Release 10 technical specifications

(LTE-Advanced). All the US and EU family members to the patents declared in

ETSI as SEPs are also included in the final results.

4G LTE IPR shareholders for standard

essential patent candidates granted in the USPTO and EPO are Alcatel-Lucent, Andrew,

Apple, BlackBerry, Ericsson, ETRI, Huawei, III, Innovative Sonic, Inventergy, Intel,

InterDigital, ITRI, LG, Microsoft, Motorola, NEC, Nokia, NSN, NTT Docomo,

Panasonic, Qualcomm, Samsung, TI and ZTE. Among 25 IPR shareholders, LG is the

leader followed by Samsung, Qualcomm, InterDigital, Motorola, Nokia (including

NSN), Ericsson, and BlackBerry. NPEs account for 19% of 4G LTE SEPs issued in

the USPTO & EPO as of July 31, 2014.

For more information, please contact Alex Lee

at alexglee@techipm.com .

©2014 TechIPm, LLC All Rights Reserved

Friday, May 16, 2014

Smartphone Patent Wars: Legal & Policy Issues of Standard Essential Patents in the ICT Industry

If you are interested in reading my J.D. thesis paper and providing me comments for improving it as a journal publication, please let me know. Thank you.

... Alex Lee (alexglee@techipm.com)

... Alex Lee (alexglee@techipm.com)

Smartphone Patent Wars: Legal & Policy

Issues of Standard Essential Patents in the ICT Industry

by

Alex Lee, Ph.D.

As

represented by “Smartphone Patent Wars,” patents for smartphones became the

most important strategic competition tool among market leaders. Especially, patents for mobile communication

standards, which are the so-called ‘Standard Essential Patents (SEPs),’ became

the center of legal and policy debates regarding their intellectual property

rights (IPRs).

The

author provides the implications of recent courts’ resolutions regarding FRAND

(Fair, Reasonable And Non Discriminatory) disputes to the ICT (Information and

Communications Technology) industry and provide several alternative options for

resolving FRAND disputes. The author

contends that the current concerted resolutions in courts and regulation

agencies can result in adverse effects to the ICT industry. The author also contends the main drawback of

the recent proposals to resolve the disputes surrounding SEPs through the ex ante FRAND licensing and the ICT

industry players’ voluntary collaboration.

From the analysis of ICT industry players’ response to the outcomes of

court resolutions, the author contends a compromising way to provide FRAND

Royalty adopting arguments from both sides of the disputes. The author also contends a practical

improvement to the voluntary collaboration proposals to resolve the disputes

surrounding SEPs.

Table of Contents

I. Introduction

II. A Holistic Review of Current Issues in

FRAND Disputes

A. Interpretation of FRAND Commitments

B. Determination of FRAND Royalty

C. Antitrust Issue

III. Implications for ICT Industry

A. Response of ICT Industry to the Courts’

Resolutions

B. Potential Adverse Effects of Courts’

Resolutions

C. Alternative Methods to Resolve FRAND

Disputes

IV. Recommendations

A. FRAND Royalty and Injunctive Relief

B. Alternative Methods for FRAND Licensing

V. Conclusion

Sunday, February 2, 2014

Internet of Things Standard Essential Patents Global IPR Governance 1Q 2014

TechIPm,

LLC’s Internet of Things (IoT) standard essential patents research for the US and

EU market of NFC, UHF RFID and Zigbee for wireless sensor networks identified

total of 380 issued patents in the USPTO and EPO as the potential candidates

for IoT standard essential patents as of January 31, 2014.

To

evaluate the essentiality of a IoT patent, patent disclosures in claims and

detail description for each NFC patent is compared to the latest versions of

NFC Forum’s standard specifications (Activity, Digital, Protocol, LLCP (Logical

Link Control Protocol), NDEF (Data Exchange Format), RF/Analog, RTD (Record

Type Definition), Connection Handover, and Tag Operation) and ISO/IEC 18092 –

2004; UHF RFID patent is compared to ISO/IEC 18000-C; and Zigbee patent is

compared to IEEE 802.15.4-2006.

Among

84 IPR shareholders, NXP is the leader followed by ZIH (Zebra), Intermec,

Symbol (Motorola Solutions), Broadcom (Innovision), Sony, Atmel, Round Rock and

Samsung.

For

more information, please contact Alex Lee at alexglee@techipm.com .

©2014

TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Labels:

Essential Patent,

Internet of Things,

NFC,

RFID,

Zigbee

Saturday, February 1, 2014

4G LTE Standard Essential Patents Global IPR Governance 1Q 2014

TechIPm,

LLC’s 4G LTE standard essential patent research for the US and EU market leader

among 4G LTE UE (cellular phones, smart phones, PDAs, mobile PCs, etc.) and

base station (eNB) product manufactures identified total of 288 issued patents

in the USPTO and EPO as the potential candidates for LTE RAN (Radio Access

Network) standard essential patents as of January 31, 2014.

To

evaluate the essentiality of a LTE patent, patent disclosures in claims and

detail description for each 4G LTE patent are compared to the final versions of

the 3GPP Release 10 technical specifications (LTE-Advanced).

4G

LTE IPR shareholders for standard essential patent candidates granted in the

USPTO and EPO are Alcatel-Lucent, Apple, BlackBerry, Ericsson, ETRI, Huawei,

III, Innovative Sonic, Intel, InterDigital, ITRI, LG, Microsoft, Motorola, NEC,

Nokia, NSN, NTT Docomo, Panasonic, Qualcomm, Samsung, TI and ZTE. Among 23 IPR

shareholders, LG is the leader followed by Samsung, Qualcomm, Nokia (including

NSN), Motorola, Ericsson and InterDigital.

For

more information, please contact Alex Lee at alexglee@techipm.com .

©2014

TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Sunday, December 15, 2013

NFC Standard Essential Patent Candidates 4Q 2013

NFC (Near field communication) is the key technology for

Smartphone wallet application: A Smartphone including an electronic wallet

provides a variety of financial and payment capabilities. The Smartphone wallet

application supports paying for products or services in much the same way as

presenting a credit card, a debit card, a smart card, a transit card, or a toll

tag for payment. The Smartphone wallet can communicate wirelessly with a

point-of-sale (POS) terminal using NFC technology to provide the appropriate

financial information to complete a payment transaction. There are many Android

and Windows phones offer NFC applications. Recently, France Brevets sued HTC

and LG for patent infringement using two Inside Secure’s NFC patents.

To find the key IPR holders for NFC patents, a keyword

search of the USPTO patent data base and ISO/IEC standard essential patents

(SEPs) data base have been performed. To evaluate the essentiality of a NFC

patent, patent disclosures in claims and detail description for each NFC patent

are compared to industry standard for NFC technology (under development by the NFC

Forum). The NFC Forum standard specifications included in the analysis are

Activity, Digital, Protocol, LLCP (Logical Link Control Protocol), NDEF (Data

Exchange Format), RF/Analog, RTD (Record Type Definition), Connection Handover,

and Tag Operation.

TechIPm, LLC’s NFC standard essential patent research for

the US market identified total of 83 issued patents as the potential candidates

for NFC SEPs as of 4Q 2013. NXP is the leader in IPR share followed by Sony,

Innovision Research & Technology, Nokia, STMicroelectronics, Inside Secure

and Samsung.

©2013 TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Saturday, December 7, 2013

Standard Essential Patents for Litigation Strategy under Innovation Act

Recently, the U.S. House

passed a new legislation (H.R. 3309) to address patent litigation abuses.

Especially, the new law (“innovation Act”) aimed at preventing patent

trolls’ frivolous patent litigations and protecting the innovation system.

Two

notable provisions that can

affect the patent litigations are pleading disclosures and discovery

that are included as a new Section 281A and 299A of Title 35 respectively. Specifically, the most significant terms are (1) complaints

should identify each patent and claim

asserted contrast with the accused products or processes to show how each asserted claim is mapped into the accused products or processes (claim charts) and (2) courts can limit

discovery to claim interpretations until a claim construction

(Markman hearing) decision

is issued.

The main issue with

the two provisions is that usually the details about the

legitimacy of the patent litigation allegations can be found only after acquiring

information from experts, reverse engineering and infringing party. Standard essential patents (SEPs) may provide

some strategic options for patent litigation strategy to overcome the two provisions because of their rather easy of infringement

proof characteristic: if one can establish essentiality of a SEP’s specific

claim, one may presume that every standard-compatible products or

processes infringe the SEP’s specific claim.

For more information, please

contact Alex Lee at alexglee@techipm.com .

©2013 TechIPm, LLC All

Rights Reserved

http://www.techipm.com/

Thursday, November 14, 2013

Round Rock (NPE) Dominates UHF RFID Standard Essential Patents

TechIPm,

LLC’s UHF RFID standard essential patent research for the US market reviles

that IPR share of Round Rock Research LLC (NPE) accounts for 13% of UHF RFID

Standard Essential Patents (SEPs) issued in the USPTO as of 3Q 2013. To

evaluate the essentiality of a UHF RFID patent, patent disclosures in claims

and detail description for each UHF RFID patent are compared to the most recent

version of the ISO/IEC 18000-C technical specifications. Total of 134

issued patents are identified as the potential candidates for UHF RFID SEPs

relating to UHF tag and reader products.

Round

Rock Research LLC was founded by a billionaire John Desmarais, a famous patent

attorney for his won in a $1.52 billion verdict for Alcatel-Lucent against

Microsoft in 2007. Round Rock Research LLC became the second-largest NPE

following the Intellectual Ventures by acquiring a portfolio of 4,500 patents

from Micron Technology Inc., the biggest U.S. maker of semiconductor chips.

Recently, Round Rock settled patent dispute with Motorola Solutions. Round Rock Research

LLC is now operating successful licensing program collaborating with IPVALUE,

an IP monetization consulting firm.

©2013

TechIPm, LLC All Rights Reserved

http://www.techipm.com/

Subscribe to:

Posts (Atom)

+Issued.jpg)