What kind of insight can you get from recent industry news about 4G IPR?

July 1, 2009: Nortel's LTE patent value may be overblown

Industry analysts have conflicting views over whether Nortel's LTE patents it retained instead of selling them to Nokia Siemens Networks (NSN) along with the LTE and CDMA businesses are worth a whole lot.

The bankrupt vendor, which is in the midst of offloading its various businesses and subsequently sold its LTE and CDMA assets to NSN for $650 million, held on to what is believed to be key LTE IPR assets, which could potentially bring in some hefty royalties. JP MorganChase analyst Ehud Gelblum has pegged the royalty figure as high as $2.9 billion in a recent research note.

Stuart Carlaw, vice president and chief research officer with ABI Research, believes the figure is overblown since the $2.9 billion figure is based on the assumption that Nortel's intellectual property could get a royalty rate of 1 percent of every LTE device sold.

"This is disproportionate to their patent holdings and cannot be seen as fair and reasonable. I doubt any other single vendor will be looking for this type of return - even Qualcomm," said Carlaw.

Carlaw expects that Qualcomm will bundle LTE with other technologies in a licensing package, meaning its LTE portion will be much less than its cumulative royalty rate.

29 June 2009: Complex LTE IPR System

Markus Münkler, Vodafone Group R&D spoke about IPR Regime for LTE at LTE World Summit, Berlin

•ETSI has improved visibility of standards essential IPR across its membership

•NGMN Ltd has produced indications of the total royalty burden of candidate technologies LTE & WiMAX

•Placed IPR royalty rates in the middle of the next generation mobile economy debate

•Raised the IPR discussions to the attention of the EU and other regulatory bodies

•Built a legally sound platform of trusted collaboration among technology stakeholdersInterim conclusion

•IPR transparency has improved among engaged industry stakeholders

•However, new challenges have emerged from outside the technologydevelopers

•Therefore, IPR royalties remain a stumbling block on mobile technology developments

June 23, 2009: Ericsson Licenses LTE IPR

STOCKHOLM -- Ericsson (NASDAQ:ERIC), a leading pioneer of LTE technology, confirms it has signed license agreements for LTE essential patents. Ericsson is a strong advocate for reasonable aggregated royalties and holds the industry's strongest LTE patent portfolio. Ericsson is now taking the lead in establishing an industry practice to promote healthy market growth. This builds on Ericsson's present global licensing program for GSM/WCDMA, now composed of more than 80 agreements and generating significant revenue.

Building on extensive experience in GSM and WCDMA, Ericsson has been driving the development of next-generation mobile technology - 4G/LTE - ever since its OFDM research in the early 1990s. Already today, at the dawn of the technology, Ericsson possesses a substantial number of standard essential patents that are key to developing 4G/LTE products.

Championing industry practice on FRAND (Fair, Reasonable and Non-Discriminatory) licensing, Ericsson makes its technology available to others. Consequently, licensing arrangements will be made according to Ericsson's proportional share of the standard IPR that relates to the relevant product category. Ericsson likewise honors the same industry practice by ensuring a maximum cumulative rate on LTE technology not exceeding a single-digit rate. This is achieved through bilateral negotiations undertaken in good-faith.

Kasim Alfalahi, Vice President and Head of IPR Licensing and Patent Portfolio at Ericsson says: "This is an important milestone for us to demonstrate our LTE leadership. We aim to strike a balance between providing value for our customers and earning a fair return on our significant R&D investments when other parties have the opportunity to benefit from them."

June 22, 2009: Organization Strives to Reduce Cost & Complexity in Licensing WiMAX Technology

The WiMAX industry reached another milestone this week with regards to the handling of patents and intellectual property rights (IPR) among WiMAX companies. On Monday, the Open Patent Alliance (OPA) issued a formal call for patents - asking companies with relevant IPR to submit them to the independent board for review.

The Open Patent Alliance (OPA) is an industry-led group that supports the development and widespread adoption of WiMAX technology by establishing a structure to create fair and transparent licensing of 4G IP-based technologies.

In some sense, the announcement may seem somewhat anti-climactic given that much of the heavy lifting had already been accomplished by getting the buy-in of many of the existing companies that have WiMAX IPR. Current participating OPA members include Acer, Alcatel-Lucent, Alvarion, Cisco, Clearwire, Huawei Technologies, Intel Corporation, and Samsung Electronics, as well as newly announced associate members Beceem, GCT Semiconductor, Sequans, and UQ Communications. Participating organizations range from semi-conductor companies, device and infrastructure manufactures to service providers.

Also this week, the OPA announced that it has selected Via Licensing Corporation to facilitate the formation and administration of the license pool. The company, an independent organization with access to technology resources, will act as a "patent referee" evaluating the claims submitted by WiMAX patent holders.

The WiMAX patent pool is similar to models used with other technologies such as MPEG. Once a call for patents is issued, companies may confidentially submit their claims to a patent administrator who will test for "essentiality." Companies that are deemed to have relevant IPR by the administrator are invited to participate in the process, during which negotiations will occur. The end result is consensus and licensing rules for those participating in the pool, a process that typically takes 12-18 months from the first call for patents."The advantages of a patent pool is that is provides transparency among intellectual property rights (IPR) for across the ecosystem," says OPA President Yung Hahn. "It reduces overall risk for those looking to develop WiMAX products and devices by making it more predictable and transparent."But what about companies that choose not to participate?

Two notable exceptions - Motorola and ZTE, both with significant WiMAX activity, are conspicuously absent from the group. "A lot of people think that you have to achieve consensus before you can form the pool," says Hahn. "That is actually not the case. The only requirement is that each of these companies get a say and get to express their view on the various positions."Companies that choose not to participate in the pool would likely seek to form separate bi-lateral license agreements with other companies. These agreements, however, can slow innovation and adoption by driving up the cost of licensing and increasing the overall licensing process. Details of the agreements are also confidential and covered by NDAs. "We are not trying to replace the bi-lateral agreements - we believe they have a place and support that. But we believe if you use bi-lateral in conjunction with patent pools, you get them done quicker with broader coverage and less effort."

Another advantage of a patent pool is that it provides a market indicator of reasonable licensee fees. If participation is strong and a significant amount of IP is collected, the pool can become a basis for disputes and litigation. "One of the things that we are trying to achieve is to create a market reference point for what is a fair and reasonable IPR framework," says Hahn. "If you create a pool and have a significant portion of IP in the pool, when you have disputes about what is fair and reasonable, the pool becomes a very credible market reference point." Another question that often comes up is how the WiMAX licensing process will compare to other technologies such as LTE. The general consensus is that WiMAX IPR is more broadly held than LTE and therefore easier to form a pool when you have a larger number of owners, than when it is more concentrated. Further complicating things, a number of organizations on the LTE side have separately begun to make separate calls for patents."

There are several different ways to do this," says Hahn. "In LTE, 3 separate groups have conducted patent calls without necessarily getting the backing of key companies and are going to use that process to secure the comments. We have done it the other way around - we went and secured commitments from 8 companies, plus we just announced 4 associate members for a total of 12. For us the patent call is the end of the process rather than the beginning of the process.""It's kind of like the Tortoise and the Hare analogy," say Hahn. " It's not so important how you start, but how you finish."

May 26, 2009: LTE patent pool efforts heat up

Earlier this month and oddly within days of each other (two were on the same day), three different companies that administer patent licensing programs issued calls for patents essential to the Long Term Evolution (LTE) standard, with the purpose of creating a patent pool for LTE.

Sisvel, VIA Licensing and MPEG LA are calling on companies claiming to hold patents essential to LTE to give them a call or send an email so they can evaluate the claims and create a patent program. MPEG LA said it has made significant progress with a group of interested companies to create a joint patent pool license for LTE. The company said its efforts began last year, and it has been educating the market about the benefits of pooling licenses. Sisvel said its effort also began last year, and it too is making a move following talks with stakeholders in the LTE field.

The goal of such pools is to create a standard and predictable licensing rate for all manufacturers. The issue arises after critics slammed what they see as exorbitant rates for 2G and 3G technologies; indeed, cell phone maker Sendo in part blamed high royalty rates for its collapse.

However, this latest turn on the LTE field likely will confuse the LTE patent domain more than offer the cost clarity. Is the race on to see how many companies each of these patent administrator firms can sign up? Moreover, all three efforts most likely are meaningless without support from all the major stakeholders involved.

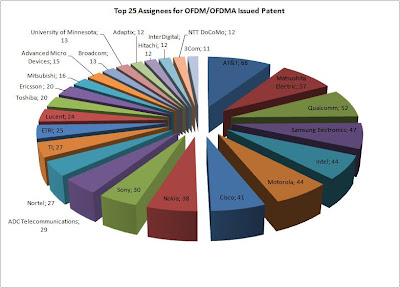

Last spring, Alcatel-Lucent, Ericsson, NEC, NextWave, Nokia, Nokia Siemens Networks and Sony Ericsson established a patent pool to provide predictable costs for licensing LTE IP. Noticeably absent were Qualcomm, Motorola and Nortel. Qualcomm has favored and likely always will favor bilateral agreements. Nortel indicated last spring that it would license its essential patents for LTE handsets at a royalty rate of 1 percent of a device's sales price. Motorola, which holds a significant amount of OFDM/OFDMA patents, hasn't been public about its plans.

I have to believe that the major vendors already are well on their way in cross-licensing deals for LTE. Qualcomm and Nokia hammered things out in July with a 15-year patent agreement that covers a number of technologies, including LTE. These large vendors are well versed in the patent game, and I don't see anything changing on the LTE playing field.

Trend and Issue analysis of patent, technology, market, and S. Korea for smartphone & 4G mobile communication:

Trend and Issue analysis of patent, technology, market, and S. Korea for smartphone & 4G mobile communication: